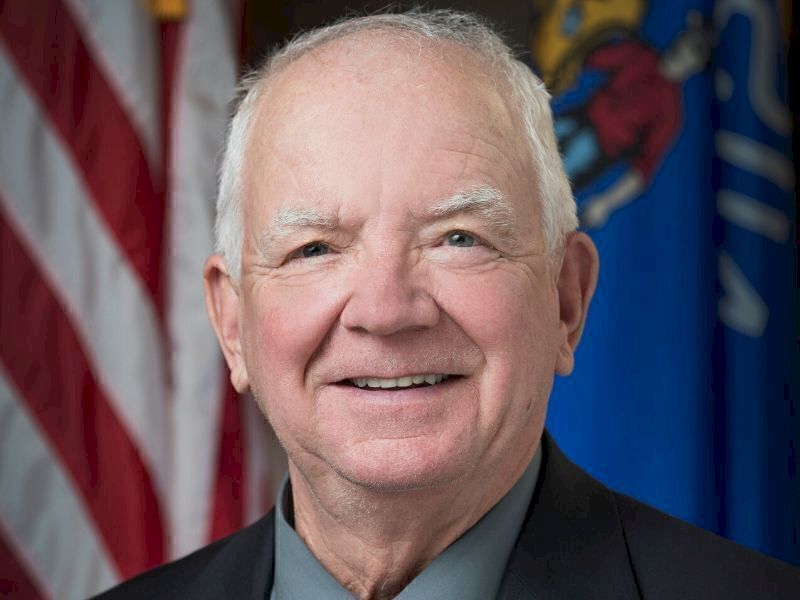

MADISON – During Tuesday’s Assembly floor session, Representative James Edming (R-Glen Flora) joined his Assembly Republican colleagues in voting for a tax relief package that would return a portion of the state's surplus to the people of Wisconsin.

The four proposals in this package would reduce the tax burden by expanding the 2nd income tax bracket, increasing the married persons tax credit as well as the child and dependent care tax credit. The package also excludes retirement income for those 65 and older, up to $75,000 of retirement income for single filers, and up to $150,000 for married-joint filers.

“Folks around the 87th District and across Wisconsin are feeling the pinch of high inflation,” said Rep. Edming. “Families everywhere are struggling to keep up with the rising costs of basic things like butter and eggs, while the state sits on over a $3 billion in surplus. It is only right that we return a portion of this surplus to the taxpayers so they can use it to best meet their needs.”

In total, these proposals would provide $2.1 billion in tax relief targeted at the middle class.

“Since I first ran for the Assembly I’ve always told folks that I believe in a bright future for Wisconsin,” said Rep. Edming. “I believe this package of tax relief will help create that bright future for our state.”

This package now advances to the State Senate for their consideration.

The 87th Assembly District includes all or portions of Marathon, Rusk, Sawyer, and Taylor Counties.

Last Update: Feb 15, 2024 11:27 am CST