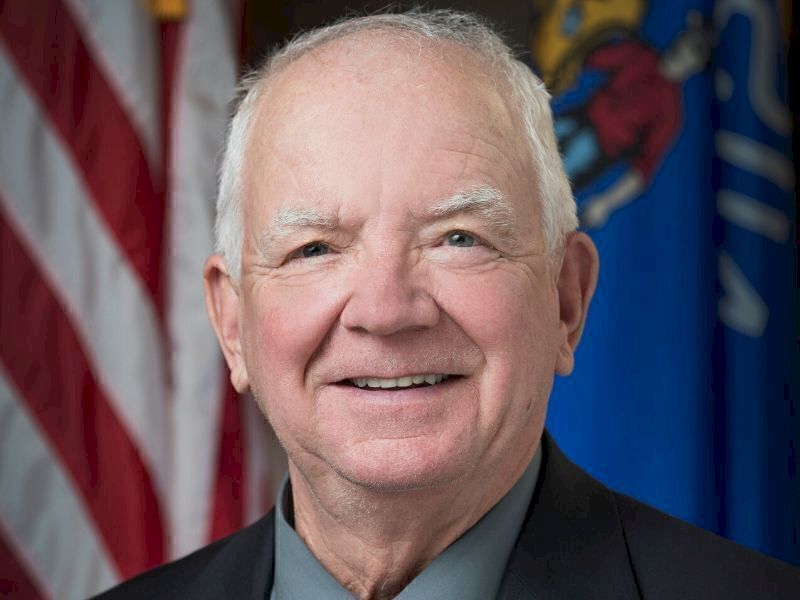

MADISON, WI -- Today, the State Assembly approved Assembly Bill (AB) 102. This bipartisan legislation, authored by Representative James Edming (R-Glen Flora), expands the eligibility for the veterans and surviving spouses property tax credit.

“As I’ve worked on this legislation over the past several years I’ve heard from veterans across Wisconsin about how receiving this tax credit will make a difference in their life,” said Rep. Edming. “When our veterans joined the military, they did so knowing that they may give their life in service to the nation we love. It is our duty to help support those who were significantly injured in defense of the freedoms we hold so dear.”

Currently, a veteran’s service-connected disability rating must be 100% for them, or their surviving spouse, to qualify for the tax credit. AB 102 makes the credit available to more of these deserving individuals by changing the threshold to a disability rating of 70% and above.

“While they certainly appreciate benefits like a free state park pass or a discounted turkey tag, this legislation will be life-changing for many of our state’s disabled veterans,” said Rep. Edming. “As chairman of the Veterans and Military Affairs Committee, I close our meetings by saying, if you love your freedom, thank a veteran. By passing this legislation that is exactly what we are doing.”

AB 102 was approved with a unanimous 96-0 vote. It now advances to the State Senate for their consideration.

The 87th Assembly District includes all or portions of Marathon, Rusk, Sawyer, and Taylor Counties.

Last Update: Feb 23, 2024 9:41 am CST